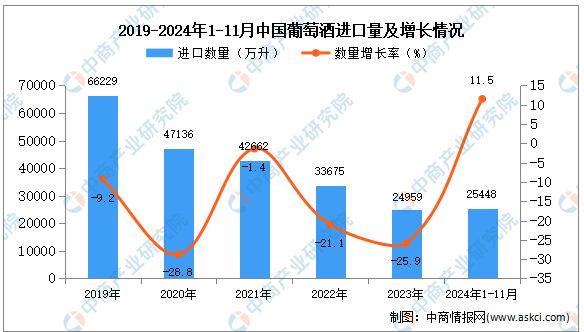

According to the General Administration of Customs,China imported 253 million liters of wine from January to November 2024 , up 11.54% year-on-year, with the value reaching $1.433 billion, a 34.34% increase compared to the same period in 2023.

The overall growth was driven almost entirely by Australian wine, which saw its import volume soar 4,620.85% and its value skyrocket 15,474.26%. Australian wine imports totaled $515 million, accounting for 35.33% of China’s total wine import value, a sharp increase from just 0.30% in 2023.

The surge is due to China’s decision in March 2024 to lift anti-dumping and countervailing duties on Australian wine.

China’s wine import data during this period shows a striking contrast, with Australian wine imports surging dramatically while imports from other major wine-producing nations continued to decline. China imported 253 million liters of wine during the period, up 11.54% year-on-year, with the value reaching $1.433 billion, a 34.34% increase compared to the same period in 2023.

Meanwhile, imports from other major wine-producing countries continued to decline.

Import from France: Volume down 20.72%, value down 10.60%; Chile: Volume down 15.04%, value down 20.31%; Italy: Volume down 12.68%, value down 3.29%;Spain: Volume down 37.02%, value down 27.06%.

New Zealand and Germany are the exceptions. Import from New Zealand: Volume up 9.99%, value up 6.60%; Germany: Volume up 12.95%, value up 11.83%.

These two countries, along with Australia, were the only top 10 wine suppliers to see growth in both import volume and value. The growth reflects the rising popularity of white wine among younger Chinese consumers, especially in casual, personal settings. Unlike traditional wine consumption tied to banquets or gifting, white wine is now enjoyed during solo drinking or informal gatherings, a trend that has driven importers to expand their white wine portfolios.